Workers must receive paychecks that are correct and on time. Coordinating payroll involves many factors, like calculating time off balances, hours worked, and providing additional benefits. To simplify and streamline compensation processes, many enterprises utilize payroll software.

Payroll software systems ensure compensation and benefits are allocated correctly for each member of your workforce. Many of the best payroll platforms include additional features as well, such as time tracking, employee self-service, onboarding solutions, and more.

If you are interested in introducing or updating payroll software for your organization, read on, as we will be analyzing and comparing the best payroll software systems available.

Read more: Best HRIS Systems for 2022

Compare Payroll Software Solutions

Below are some of the best payroll software platforms for simplifying and streamlining your organization’s compensation processes and responsibilities.

| Vendor | Dashboard | Management | Compliance | Mobile App | Requests | Integrations |

|---|---|---|---|---|---|---|

| ADP Workforce Now | ||||||

| Gusto | ||||||

| QuickBooks Payroll | ||||||

| BambooHR | ||||||

| Rippling | ||||||

| Paychex Flex |

ADP Workforce Now

Best for: Tax functionality

ADP Workforce Now is a payroll software solution for midsize and large businesses. It saves time for its users with its payroll, employee onboarding, reports, dashboards, and self-service features.

A unique feature of this payment software product would be its tax capabilities. It can help businesses with tax and compliance processes, allowing them to manage and sync tax deductions to their payroll for federal, state, and local taxes.

Another notable factor would be its accessibility. Since the product is web-based, it can be accessed on any device. Additionally, it has a self-service mobile app, allowing users to access the service through their mobile devices wherever they go.

This system can be great for anyone who wants to handle their onboarding and payment management easily on the go while improving their leadership through insights gained from the tool’s statistical reports.

Gusto

Best for: Automated payments

Gusto’s payroll platform is a smart tool that streamlines payment processes. The tool has features for various compensation and benefits processes, including worker’s comp, health insurance, 401(k), time tracking, PTO, and more.

With the Gusto payroll platform, users can also calculate taxes and file them directly through the system. One drawback, however, is that the mobile app does not allow full access to employee features.

Employee onboarding forms are stored and organized within the online system for easy access — by those with permission, that is. The tool can help you with all of your employee payment needs, even for international contractors in more than 80 countries.

An interesting capability of the product would be its AutoPilot tool. This allows users to set up automatic payments that can be processed for their salaried employees with fixed schedules. This can save effort and ensure proper, on-time payments. On the whole, this software is suitable for users who want to utilize the automated features to save time and effort on recurring tasks.

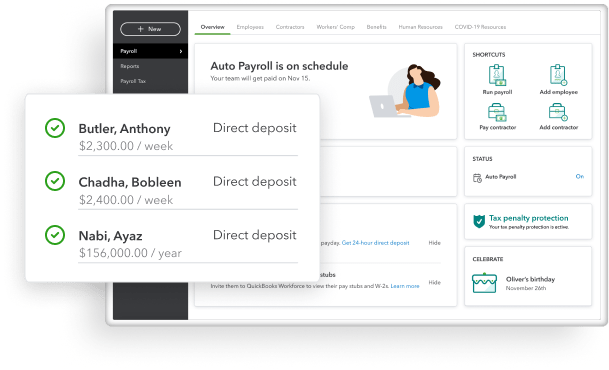

QuickBooks Payroll

Best for: Scalability

This payroll software by QuickBooks provides three different levels for users. The least expensive plan includes full-service payroll features, auto-payroll capabilities, health benefits, 401(k) plans, and forms. The mid-tier plan has each of these features and a few more, like faster direct deposits, HR support, expert review, and time tracking on the go. Finally, the most expensive plan has all the previously mentioned features and some extras, like expert setup, tax penalty protection, and more advisors/support.

The workforce portal, offered on all plans, allows employees to view their pay stubs, W2 forms, withholding allowances, and PTO balances online. This can help your team members feel more confident and in control of their payroll processes.

A small drawback of this software is how limited its integrations are. The software can work with QuickBooks online and ADP, but more third-party integrations could be helpful for data analysis.

This software is great for startups or growing teams, as the plans can scale as needs increase. That way, users can begin with one of the less expensive plans with fewer features, and move on to higher plans with more capabilities as needed.

BambooHR

Best for: Performance management features

BambooHR provides HR software that has many of the features of payroll software. The tool helps with onboarding and compensation, as well as gathering, storing, and analyzing sensitive data.

Like many other payroll systems, BambooHR has capabilities for issuing compensation. These would include time tracking, PTO, benefits, payroll, and more. Onboarding processes are also simplified by the tool, including onboarding forms, e-signature capabilities, and onboarding checklists.

This software is unique, as its HR features allow users to manage their employee satisfaction and performance. Being able to gain insights about each of your employees can help reduce workplace issues and boost productivity and morale.

This product is helpful for anyone who wants to simplify their HR team tasks and would enjoy having more control over their employees’ performance.

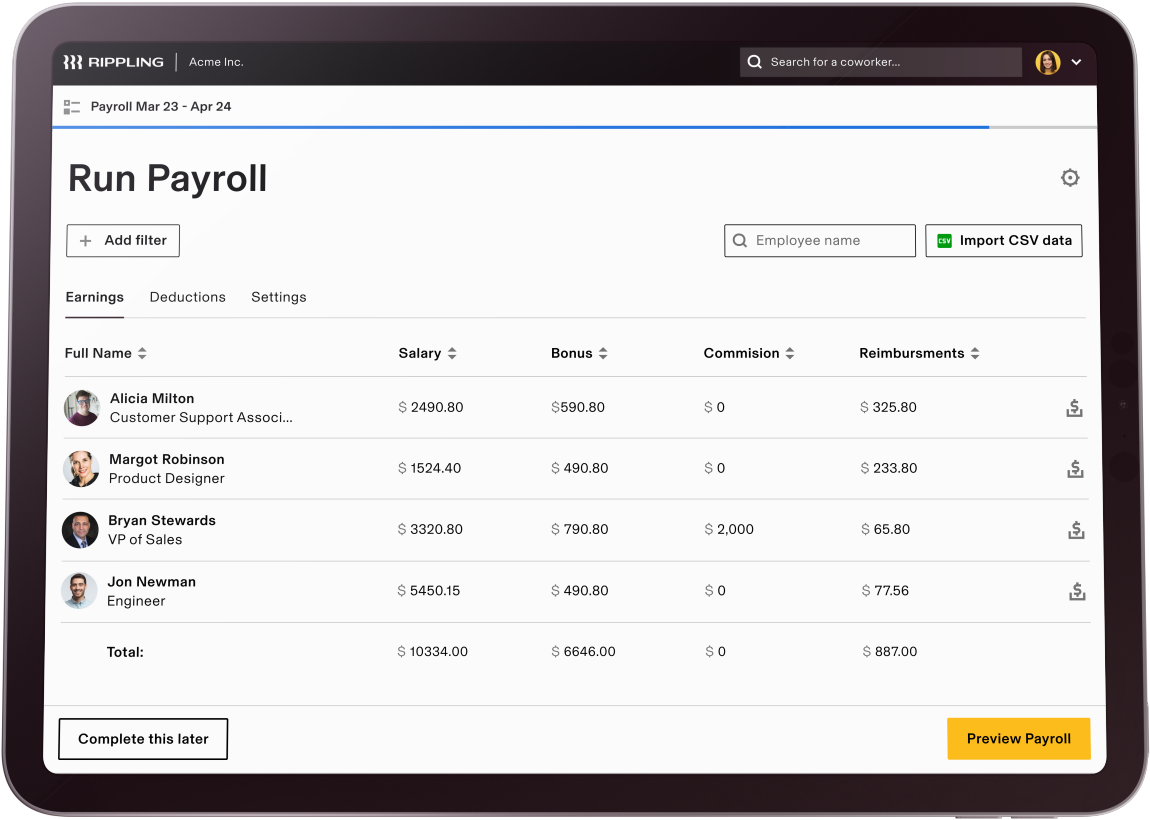

Rippling

Best for: Reporting tools

Rippling payroll software allows business leaders and HR teams to automate their payroll and HR processes together, saving time and effort for teams. Compliance and tax filing are processed automatically through the software, with onboarding forms and automatic calculations. The system also syncs with over 400 different external systems, allowing for smooth integrations.

What’s really helpful about this software is its reporting capabilities. The system provides a library of prebuilt reports, as well as the ability for users to create custom reports. These can be made, visualized, and shared with others through the system, allowing users to gain helpful insight and improve their work processes.

Another exciting capability of the tool would be Job Costing. This feature shows users the time their teams spent on tasks, clients, or locations — and the money that each of these activities cost the organization. Again, this could be very helpful for analyzing and cutting down on costs.

This software is recommended for anyone looking to gain insights from the reporting and cost features of their payment software.

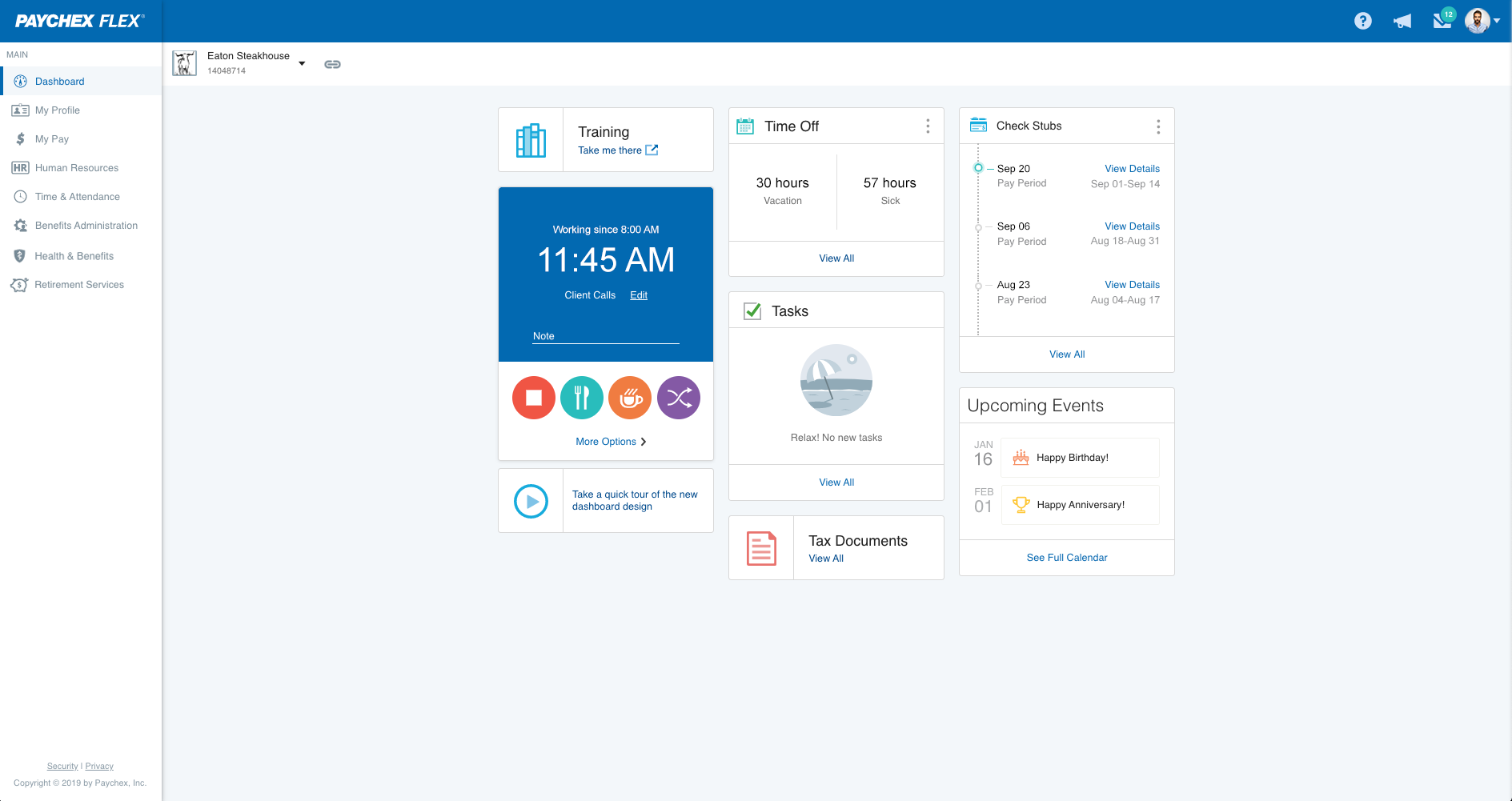

Paychex Flex

Best for: Self-employed workers

Another popular tool for payroll and HR solutions would be Paychex Flex. This software can be used in an online, remote, or hybrid workspace. It can take care of tasks for HR, time and attendance, retirement and 401(k), payroll services, and health and benefits.

The mobile app allows on-the-go time tracking for employees, and time tracking can also be automated through the system. Paychex Flex also offers an excellent selection of health and benefits, as they have partnerships with top-tier carriers.

This software has different solutions for users based on the size of the team. They even have a plan for self-employed workers. The other plans go from 1–10, 10–49, and 50–1,000+ workers. This platform can also be great for growing businesses looking for a software system to help with their payroll needs each step of the way as they grow.

Major Features of Payroll Software Solutions

While payroll features alone are helpful for businesses, payroll solutions often provide additional capabilities that can further benefit an organization. Below are some of the significant features you can look for when choosing payroll software for your team.

Benefits Dashboard

A benefits dashboard can be helpful for organizations looking to manage their employee benefits. Having all of the relevant benefit information online in a self-service platform can simplify the process of selecting benefits, as well as making your team members feel more confident and in control.

Forms Management

The ability to manage and store important forms within a single platform can help with onboarding, as necessary documentation can be managed and uploaded within the software tool. Further, user access permissions will keep the documentation secure, so sensitive information is kept private.

Taxes & Compliance

Most payroll software systems have features for tax compliance and management. This can make tax season more manageable and ensure appropriate filing procedures are followed within your organization. In addition, some software solutions even allow users to file their taxes easily within the system.

Self-Service Mobile App

While mobile apps are great for viewing information on the go, self-service mobile apps let your employees report and adjust their timekeeping in the app. This means that, rather than having to wait to fill out timesheets, they can do so immediately from wherever they are.

Time Off Requests

Time off requests are simplified in some software tools, allowing team members to request PTO in advance through the system. This means that, rather than spending time writing an email to their supervisor, they can easily send the request within the system with a few simple clicks.

Third-Party Integrations

Third-party integrations are always helpful for workplace software. With payroll software specifically, this means you can extend the functionality of the platform, accessing information and data from other enterprise tools. In this way, you’ll have an easier time viewing and using all of your data.

Benefits of Payroll Software Solutions

Implementing payroll software can provide many benefits for your business or organization. First, mistakes in timesheets and payments can be avoided, as these systems provide accurate calculations based on time worked, holidays, paid leave, overtime, and more.

Data within the software is secured through passwords and customizable permissions, so using tools like these can help protect your team’s sensitive information. With all of the features of the software, your management and HR teams save time and effort on payroll tasks, which can save the organization money.

Finally, you can expect to see a boost in morale and productivity from your team members, as they will not have to worry about receiving incorrect pay or benefits.

Choosing a Payroll Software Tool

Choosing a payroll tool for your organization can be highly beneficial if done with your team’s needs in mind. For example, your work team’s size and projected growth can help you determine whether you would need a system that is more scalable. Alternatively, if you are concerned with the progress of your work team, some software systems have features for managing employee performance.

By assessing the needs of your workforce, you can make a well-informed decision about what software would be most advantageous for your organization.

Read next: Best File Sharing Software for 2022