Hackers Increasingly Spoof Authentic Identities

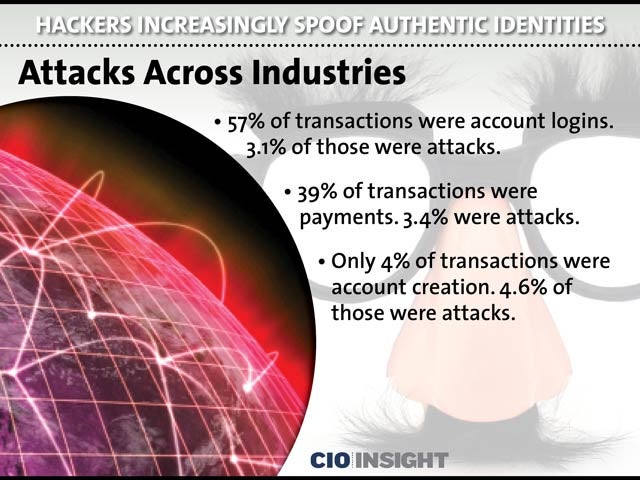

Attacks Across Industries

Attacks Across Industries

57% of transactions were account logins. 3.1% of those were attacks. 39% of transactions were payments. 3.4% were attacks. Only 4% of transactions were account creation. 4.6% of those were attacks.

Fraud to Move From POS to Online

Fraud to Move From POS to Online

As the U.S. moves toward end-to-end point-of-sale (POS) encryption and “chip and signature” (EMV), POS fraud will transition to online fraud, as it has done in Europe.

Transactions Analyzed by Industry

Transactions Analyzed by Industry

44% of financial services transactions were analyzed. Attacks: 1%, 31% from e-commerce. Attacks: 4%, 25% from media customers. Attacks: 9%

Problems With Stored Credit Card Info

Problems With Stored Credit Card Info

Fraud attacks from card-not-present chargebacks have expanded to account takeovers through email addresses and shared passwords for authentication. Although stored credit card information is convenient, it’s an easy target for criminals.

Online Authentications Plague Banks

Online Authentications Plague Banks

Financial institutions have shifted from detecting irregular account access to stopping valid customers from being “caught in the fraud net.” Without automated real-time analysis, banks cannot discern legitimate logins from fraudulent ones, so they are using people to review alerts.

Media: Most Attacks Per Transaction

Media: Most Attacks Per Transaction

Because only an email address and password are required by media sites, they suffer the highest rate of attacks per transaction. Most are fraudulent account logins motivated by the potential to reach large audiences for advertising, distributing malware and confidence scams.

Spoofing Is Top Attack Method

Spoofing Is Top Attack Method

Device spoofing: 6.2%, Identity spoofing: 4.7%, Geographic spoofing: 2.7%, IP spoofing: 2.3%, Man-in-the-Browser or BOT: 2.1%

Spoofing by Transaction Type

Spoofing by Transaction Type

Spoofing is the most frequent type of attack across transactions. Device and identity spoofing were most frequent, with account creation enduring 5.2% and 9.4%, respectively. account logins had 6.4% and 4.7%, and payments had 4.8% and 5.1%.

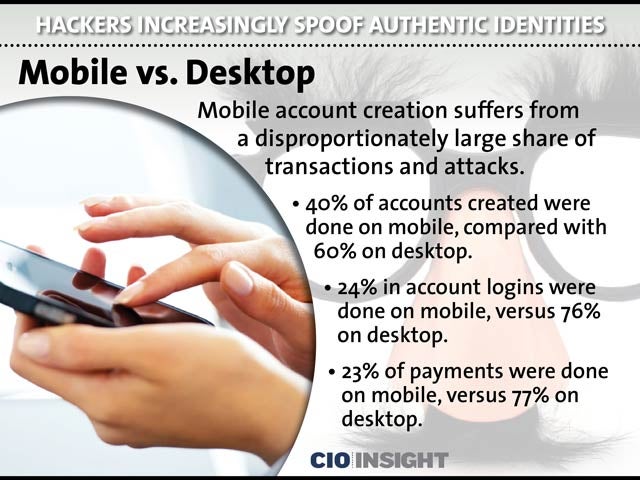

Mobile vs. Desktop

Mobile vs. Desktop

Mobile account creation suffers from a disproportionately large share of transactions and attacks. 40% of accounts created were done on mobile, compared with 60% on desktop. 24% in account logins were done on mobile, versus 76% on desktop. 23% of payments were done on mobile, versus 77% on desktop.

Attacks by Transaction Type

Attacks by Transaction Type

The largest percentage of attacks are experienced on desktops, regardless of the type of transaction. Account creation: mobile: 3.8%, desktop: 5.2%, Account logins: mobile: 1.3%, desktop: 3.6%, Payments: mobile: 2.0%, desktop: 3.8%